Welcome readers, today we delve deeper into the concept of good versus bad debt. This…

bawerk.net

Recent News

The Dark Side Of Cat Breeders Unveiling The Truth Stray Cats Living In Poor Conditions Cat Population Out Of Control

Cat breeding may seem like a glamorous endeavor, with pedigreed felines fetching high prices and…

A Big Piece In Americas Energy Revolution Puzzle

Are you ready to dive into “A Big Piece In Americas Energy Revolution Puzzle”? Let’s…

Stupid Is What Stupid Does Secular Stagtion Redux

In the world of music, certain songs have the power to transcend time and space,…

Playful Feline Favorites Discover The Perfect Cat Breed

Attention all cat lovers! Are you on the hunt for the perfect feline companion? Look…

Another Petro State Throws In The Towel The Last Il In The Petrodollar Coffin

Another Petro State Throws In The Towel The Last Il In The Petrodollar Coffin This…

What A Negative Swap Spread Really Means

When delving into the world of finance, there are many intricacies that can seem complex…

Academic Skullduggery How Ivory Tower Hubris Wrecks Your Life

Are you tired of being a victim of academic skullduggery? Do you feel like ivory…

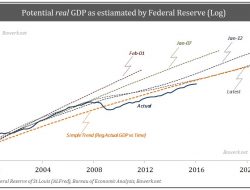

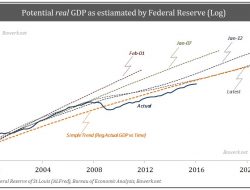

Why The Federal Reserve Will Taper In September

In the world of finance, the Federal Reserve holds a position of immense power and…

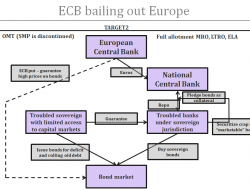

A Complete Guide To European Bail Out Facilities Part 1 Ecb

Are you curious about the intricacies of European bail-out facilities, particularly focusing on the role…

No More Posts Available.

No more pages to load.