As we navigate the complex landscape of the economy, there looms a pressing question on the minds of many: When is the next recession coming to the United States? While predicting the exact timing of a recession is a challenging task, there are certain indicators that experts closely monitor to gauge the health of the economy and anticipate potential downturns. In this article, we will delve into these indicators and explore the signs that suggest a recession may be on the horizon.

The Stock Market: A Barometer of Economic Health

The stock market is often seen as a reflection of the overall state of the economy. When stock prices are on the rise, it is typically indicative of strong investor confidence and a thriving economy. Conversely, a significant downturn in the stock market can signal underlying issues that may lead to a recession. Tracking key stock market indices such as the S&P 500 and the Dow Jones Industrial Average can provide valuable insights into the sentiments of investors and the broader market dynamics.

Unemployment Rates: A Vital Economic Metric

Unemployment rates are a crucial metric that economists closely monitor to assess the health of the labor market. Low unemployment rates signify a robust economy with high levels of job creation and consumer spending. Conversely, a rise in unemployment rates can signal economic distress, as businesses may be cutting back on hiring and consumers may be scaling back on spending. Keeping a close eye on unemployment trends can offer valuable clues about the overall economic outlook.

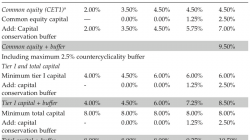

Yield Curve Inversion: A Warning Sign of Recession

One of the most closely watched indicators of an impending recession is the yield curve inversion. This occurs when long-term interest rates fall below short-term interest rates, signaling a potential economic downturn. Historically, yield curve inversions have preceded many recessions, making them a critical indicator for economists and investors. Monitoring the yield curve and any signs of inversion can provide valuable insights into the timing of a potential recession.

Consumer Confidence: A Key Driver of Economic Activity

Consumer confidence is another essential indicator that can provide valuable insights into the state of the economy. When consumers are confident about their financial prospects, they are more likely to spend money on goods and services, driving economic growth. On the other hand, a decline in consumer confidence can lead to decreased spending and slow down economic activity. By tracking consumer sentiment and spending patterns, economists can gain a better understanding of the health of the economy.

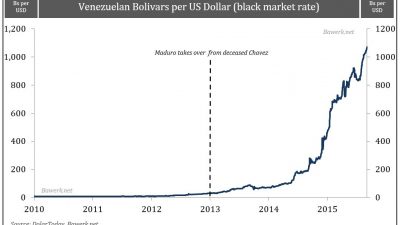

Global Economic Trends: A Window into the Future

In today’s interconnected world, global economic trends can have a significant impact on the US economy. As economies around the world become increasingly intertwined, developments in major global markets can influence the direction of the US economy. Monitoring key indicators such as global trade activity, currency exchange rates, and geopolitical events can offer valuable insights into the potential risks and opportunities facing the US economy.

The Path Forward: Navigating Uncertain Times

As we analyze these key indicators and assess the current state of the economy, it is essential to approach the future with caution and preparedness. While predicting the exact timing and severity of a recession is challenging, staying informed and vigilant about economic developments can help individuals and businesses navigate uncertain times. By staying attuned to key economic indicators, maintaining financial prudence, and planning for potential challenges, we can better position ourselves to weather economic storms and emerge stronger on the other side.