The cyclical nature of economic systems has long been a subject of interest and debate among economists, policymakers, and the general public. One of the most well-known and studied economic cycles is the “Boom and Bust” cycle, which refers to the recurring pattern of rapid economic growth followed by a sharp contraction. This phenomenon has significant implications for various aspects of society, from individual financial stability to national economic policy. In this in-depth analysis, we will explore the nature of the Boom and Bust cycle, its causes, effects, and potential solutions.

The Rise and Fall: Understanding the Boom and Bust Cycle

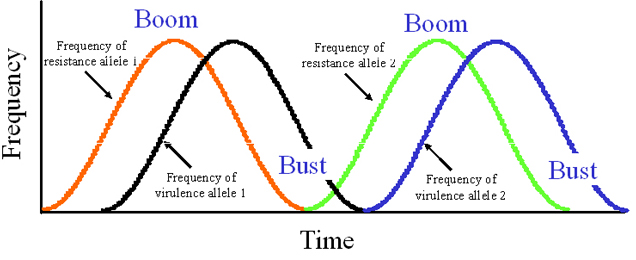

At the heart of the Boom and Bust cycle is the concept of economic expansion and contraction. During a boom phase, an economy experiences high levels of growth, characterized by increasing production, consumption, and investment. This period is often marked by rising asset prices, expanding credit availability, and overall optimism about future prospects. However, this rapid growth is often unsustainable and can lead to imbalances in the economy, such as overinvestment, excessive debt, and inflated asset values.

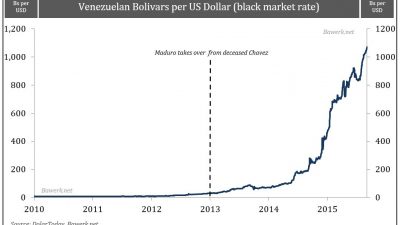

The turning point in the cycle comes when these imbalances become apparent and the economy begins to contract. This bust phase is typically characterized by falling production, declining consumer spending, and rising unemployment. As asset prices plummet and debt burdens become unsustainable, businesses may fail, banks may collapse, and individuals may lose their savings. The severity and duration of the bust phase can vary widely, depending on the underlying causes and the policies implemented to address them.

Causes of the Boom and Bust Cycle

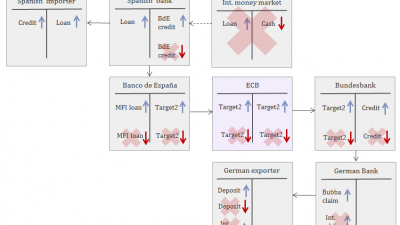

There are several factors that can contribute to the emergence of a Boom and Bust cycle. One key driver is the availability of credit and the behavior of financial institutions. During a boom phase, banks and other lenders may become increasingly willing to extend credit to businesses and individuals, fueling investment and consumption. However, this credit expansion can lead to the buildup of unsustainable levels of debt, which can trigger a bust when borrowers are unable to repay their loans.

Another factor that can contribute to the Boom and Bust cycle is asset price bubbles. During a boom phase, investors may become overly optimistic about the future prospects of certain assets, such as real estate or stocks, leading to a rapid increase in their prices. This asset price inflation can create a self-reinforcing cycle, as rising prices attract more investors, further driving up prices. However, when the bubble eventually bursts, asset prices can collapse, leading to widespread financial losses and economic downturn.

Effects of the Boom and Bust Cycle

The Boom and Bust cycle can have wide-ranging effects on individuals, businesses, and governments. During a boom phase, individuals may experience increased wealth and prosperity, as rising asset prices and strong economic growth create opportunities for investment and consumption. However, the subsequent bust phase can wipe out these gains, leading to financial hardship, job losses, and reduced living standards.

Businesses are also affected by the Boom and Bust cycle, as they must navigate the challenges of volatile demand, shifting market conditions, and uncertain economic prospects. During a boom phase, businesses may expand rapidly, taking on new projects and investments in anticipation of continued growth. However, when the bust phase hits, many of these investments may prove unprofitable, forcing companies to cut costs, lay off workers, and restructure their operations to survive.

Governments are not immune to the effects of the Boom and Bust cycle, as they must grapple with the economic and social consequences of fluctuating growth and employment. During a boom phase, governments may see increased tax revenues and reduced social welfare spending, as a strong economy lifts incomes and reduces poverty. However, when the bust phase arrives, governments may face declining revenues, rising demands for social assistance, and pressure to stimulate economic activity through monetary and fiscal policy.

Solutions to the Boom and Bust Cycle

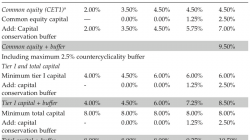

Addressing the underlying causes of the Boom and Bust cycle requires a multifaceted approach that involves coordination between monetary, fiscal, and regulatory authorities. One key strategy is to ensure that credit is allocated efficiently and responsibly, to prevent the buildup of excessive debt levels that can destabilize the financial system. This may involve implementing macroprudential policies that limit the growth of credit during boom periods and promote financial stability.

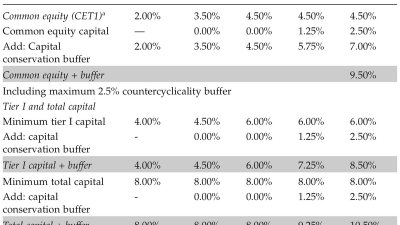

Another important element of preventing the Boom and Bust cycle is to enhance financial regulation and supervision, to limit the emergence of asset price bubbles and speculative excesses. Regulators can use tools such as capital requirements, stress testing, and transparency measures to monitor and mitigate risks in the financial system, reducing the likelihood of a sudden collapse in asset prices.

In addition, policymakers can use countercyclical fiscal and monetary policies to smooth out the fluctuations in the economic cycle and support sustainable growth. During a boom phase, governments can save resources for a rainy day, by running budget surpluses and building up fiscal buffers. When the bust phase hits, these reserves can be used to stimulate demand, support vulnerable households and businesses, and prevent a deep and prolonged recession.

In conclusion, the Boom and Bust cycle is a recurring feature of economic systems that presents both challenges and opportunities for individuals, businesses, and governments. By understanding the causes and effects of this cycle, and implementing prudent policies to mitigate its impact, societies can better navigate the ups and downs of the economic rollercoaster.